|

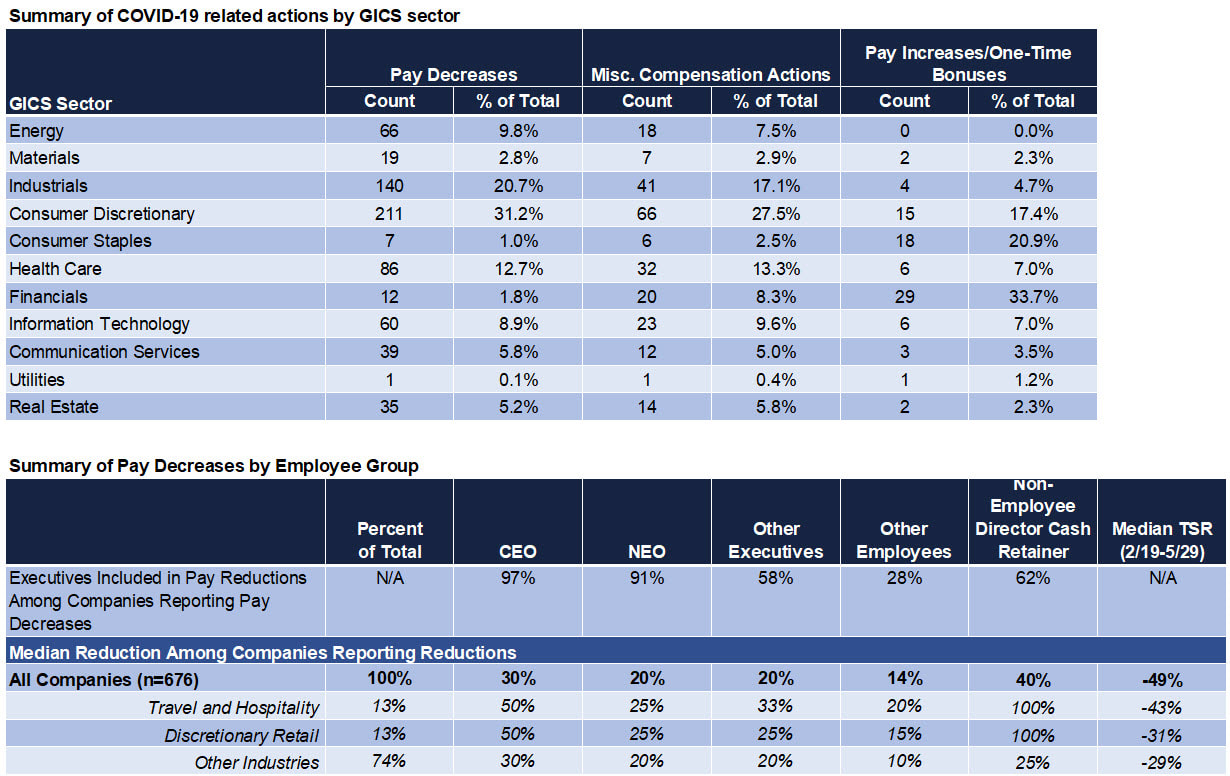

The economic fallout resulting from the COVID-19 pandemic has rendered obsolete many executive incentive plans, and compensation committees are expected to apply significantly more discretion for 2020 than is typical. This Client Briefing provides a framework for the use of discretion in incentive plans. A logical framework may help companies avoid arbitrary and confusing outcomes.

Click here to download this Client Briefing in PDF. Last Updated: June 3, 2020

Note: Contact your Exequity Advisor for detailed information underlying these summary statistics and for special data cuts. After much anticipation, CEO Pay Ratio data began appearing in proxy statements this year. With the new trove of disclosures available, it’s natural for observers of executive compensation to search for trends in the data, despite seemingly universal agreement that few, if any, meaningful insights may be found. What insights are to be gleaned? What conclusions may be drawn? What does it say about pay? The purpose of this Client Briefing is to provide guidance on what the data says—and what it doesn’t.

Download Client Briefing (PDF) GOP Tax Proposal Eviscerates Current Executive Compensation Designs and Practices—Perhaps?11/10/2017

On November 2, 2017, the House Ways and Means Committee released the GOP's Tax Proposal, also known as the Tax Cuts and Jobs Act and the potential harbinger of death for many current executive compensation programs. The Tax Proposal has already been amended by the Chairman of the House of Representatives' Ways and Means Committee, and is likely to undergo further changes as it winds its way through Congress. Also, the Senate released a summary of its plan late on November 9 and reconciliation between the House and Senate bills will need to occur. President Trump wants this signed into law by Christmas, so there is a lot to be done in a very short period of time. Thus, there could be many changes between now and then, including the possibility of no bill.

This Client Alert details the "worst-case scenario" key provisions that impact executive compensation directly and also discusses the immediate issues companies need to think through so they at least have some chance to take action before December 31, 2017 if they want to try and address some of the potential issues that this Tax Proposal would raise if it makes it into law in its current form before the end of the year. Download Client Alert (PDF) On September 21, 2017, the SEC released several items providing additional guidance regarding CEO Pay Ratio. The new guidance took the form of an SEC Release, guidance from the Division of Corporation Finance, and new, modified and withdrawn Compliance and Disclosure Interpretations. The Exequity Client Alert reviews all of this new guidance.

Download Client Alert [PDF] On August 5, 2015, the SEC issued the final CEO Pay Ratio rule. This Client Alert looks at the requirements of the rule and points out differences from the rule as proposed back in 2013.

Download Client Alert (PDF) On January 31, 2014, Bloomberg BNA's Pension & Benefits Daily published this article by Exequity's Ed Hauder. The article looks at companies whose say-on-pay (SOP) votes failed in 2012 (and 2011) and who have reported their SOP votes for 2013, and some of the actions these and other companies with failed SOP votes can take to turn things around, as well as the success this group of companies had with their 2013 SOP votes. Charts looking at 2011, 2012 and 2013 SOP votes, change in CEO total compensation, and total shareholder return (TSR) for the 1-, 3- and 5-year period as of the most recent fiscal year-end to 2011, 2012 and 2013 are also included.

Download Article (PDF) On September 18, 2013, more than three years after the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) became effective, the Securities and Exchange Commission (SEC) issued a proposed rule to implement the mandate contained in Section 953(b) of the Dodd-Frank Act. This Client Alert looks at the proposed CEO Pay Disclosure Rule and discusses some of the rule's issues and implications.

Download Client Alert (PDF) On October 9, 2012, Bloomberg BNA's Pension & Benefits Daily published this article by Exequity's Ed Hauder. The article looks at companies whose say-on-pay (SOP) votes failed in 2011 and have reported their SOP votes for 2012, some of the actions these and other companies with failed SOP votes can take to turn things around, as well as the success this group of companies had with their 2012 SOP votes, and includes charts looking at 2011 and 2012 SOP votes, change in CEO total compensation, and TSR and percentile rank against companies' GICS groups.

Download Article (PDF) |

Categories

All

|

Services |

Company |