|

On October 26, 2022, the SEC issued its final clawback rules under Section 954 of the Dodd-Frank Act. The NYSE and Nasdaq filed their proposed listing standards to implement the SEC's clawback rules on February 22, 2023, which remain subject to SEC publication and a comment period.

This Client Alert looks the the new clawback rules' requirements and what they mean for companies along with considerations as companies look to ensure their clawback policies will be compliant. Click HERE to download the Client Alert in PDF. On February 10, 2023, the SEC posted new compliance and disclosure interpretations (C&DIs) covering the new pay versus performance (PVP) disclosures.

The Client Alert looks at these C&DIs and offers a sample table that can be used in the footnotes to the PVP Table to comply with the C&DI requiring more details of equity award adjustments, which cannot be provided on an aggregate basis and must be shown by specific categories. Click HERE to download the Client Alert in PDF. On December 14, 2022, the SEC released final amendments to the Rule 10b5-1 trading plans. Rule 10b5-1 provides an affirmative defense to insider trading for individuals and issuers that trade stock under a plan entered in good faith at a time when they do not possess material nonpublic information. The final amendments provide additional requirements in order to avail oneself of the affirmative defense to insider trading allegations.

Click here to download the Client Alert in PDF. On August 25, 2022, the SEC issued its final pay versus performance (PVP) rules under Section 953(a) of the Dodd-Frank Act, effective for proxy and information statements covering fiscal years ending on or after December 16, 2022. Thus, these new rules will generally apply to proxy statements filed in 2023.

These final PVP rules impose new disclosure requirements on public companies. This Client Alert reviews these new disclosure requirements and offers Exequity's comments on them, as well as provides next steps for companies to take now before the traditional proxy drafting starts later this year. Click here to download the Client Alert in PDF. In this Client Briefing, Exequity explores the distribution of ESG oversight within board committee charters across S&P 100 companies. We examine overall prevalence of ESG responsibility, different areas of ESG oversight, and how ESG focus areas are allocated between committees.

Key findings include:

Click here to download the Client Briefing in PDF. This Client Alert looks at the proposed rules released by the SEC on December 15, 2021 regarding Rule 10b5-1 trading plans and company share repurchases. The SEC is proposing new requirements for the use of Rule 10b5-1 trading plans on both those adopting such plans and the company whose securities are covered by such plans. Regarding company share repurchases, the SEC has proposed new reporting requirements, including a new form.

The SEC is accepting comments for 45 days after the proposed rules are published in the Federal Register. Click here to download the Client Alert in PDF. This Client Alert looks at the newly published policy updates for the 2022 proxy season from Glass Lewis and ISS.

Glass Lewis's updates apply starting January 1, 2022, while ISS's policy updates apply to shareholder meetings held on and after February 1, 2022. Neither Glass Lewis nor ISS announced any significant compensation-related policy changes for 2022. Click here to download the Client Alert in PDF. In this Client Briefing, Exequity explores the usage of relative total shareholder return (RTSR) within long-term incentive plans across S&P 500 companies. We examine overall prevalence of RTSR, differences in usage between industry sectors, and key design elements of these plans.

Key findings:

Click here to download the Client Briefing in PDF. In late January 2021, Glass Lewis provided additional guidance with respect to how it may approach executive pay responses to the COVID-19 pandemic. Previously, Glass Lewis had provided some guidance, but it has now launched a dedicated web page to COVID-19 and issued additional guidance concerning how COVID-19 may impact its analyses under its various policies. This Client Alert summarizes the key guidance that Glass Lewis recently provided, which companies should review as they prepare their 2021 proxy statements.

Click HERE to download the Client Alert in PDF. Both ISS and Glass Lewis recently released their policy updates for 2021. Surprisingly, neither ISS's nor Glass Lewis's policy updates had any major policy changes with respect to compensation. This Client Alert details the policy updates of both ISS and Glass Lewis, even those not necessarily presented as policy updates that will nevertheless have an impact on compensation matters for the 2021 proxy season.

Click HERE to download the Client Alert in PDF. This Client Alert looks at the final rules impacting proxy advisors that the SEC adopted July 22, 2020. The Client Alert discusses the SEC action to codify that "solicitation" includes providing proxy vote recommendations, modifications of the anti-fraud provision to address failure of proxy advisors to disclose material information, the implications of these changes for proxy advisors, and details of the "safe harbor" proxy advisors can use to avoid having to comply with the proxy voting rules.

The final rules are effective 60 days after publication in the Federal Register. However, the final rules do not apply to proxy advisors until December 1, 2021. Click here to download the Client Alert in PDF. In this Client Briefing, Exequity explores the usage of relative total shareholder return (RTSR) within long-term incentive plans across S&P 500 companies. We examine overall prevalence of RTSR, differences in usage between industry sectors, and key design elements of these plans.

Key findings:

Click here to download the Client Briefing in PDF. Seemingly overnight, the COVID-19 pandemic gripped the World, and many business forecasts and operating budgets were severely impacted. Before the end of the first quarter, incentive plan performance goals were suddenly deemed unattainable. While most companies are not currently considering adjusting in-cycle incentive plan performance goals, due either to concerns about external optics or a lack of sufficient context, assessing performance for the purposes of incentive plan payouts will be a deeply deliberated topic during year-end pay discussions. We expect that for many companies, incentive plan performance assessment is likely to include the application of backward-looking discretion, informed by a comprehensive review of a variety of quantitative and qualitative factors. This article provides an analytical approach to support the application of discretion.

Click here to download the Client Briefing in PDF The significant stock price declines of many companies over the past few months have raised the question of whether a company’s traditional approach to impending equity awards should be revised. The first widescale evidence of companies’ responses to this dynamic is unfolding in the context of 2020 director equity awards. This Client Alert analyzes the equity grant practices of 109 S&P 500 companies holding their annual meetings between April 1, 2020 and May 1, 2020 to identify trends in director equity grant policies resulting from the market impact of COVID-19.

Click here to download the Client Alert in PDF. Do you think the effect of COVID-19 has destroyed your company’s 2020 bonus plan? Many companies are taking a “wait and see” approach to how they will ultimately evaluate the impact of the pandemic on incentive plan performance goals. When the time is right, that assessment is likely to include the application of backward-looking discretion, informed by a comprehensive review of a variety of quantitative and qualitative factors. However, many companies will likely be uncomfortable with both the ambiguity of an undefined and arbitrary “discretionary” review process, and the well-established negative connotations associated with the exercise of discretion in setting pay. As a result, many companies will be looking for well-reasoned, easily articulated approaches to applying discretion. This Client Alert offers one example of the analytical approach that companies may consider in evaluating 2020 performance while maintaining pre-COVID-19 performance frameworks.

The economic fallout resulting from the COVID-19 pandemic has rendered obsolete many executive incentive plans, and compensation committees are expected to apply significantly more discretion for 2020 than is typical. This Client Briefing provides a framework for the use of discretion in incentive plans. A logical framework may help companies avoid arbitrary and confusing outcomes.

Click here to download this Client Briefing in PDF. Last Updated: June 3, 2020

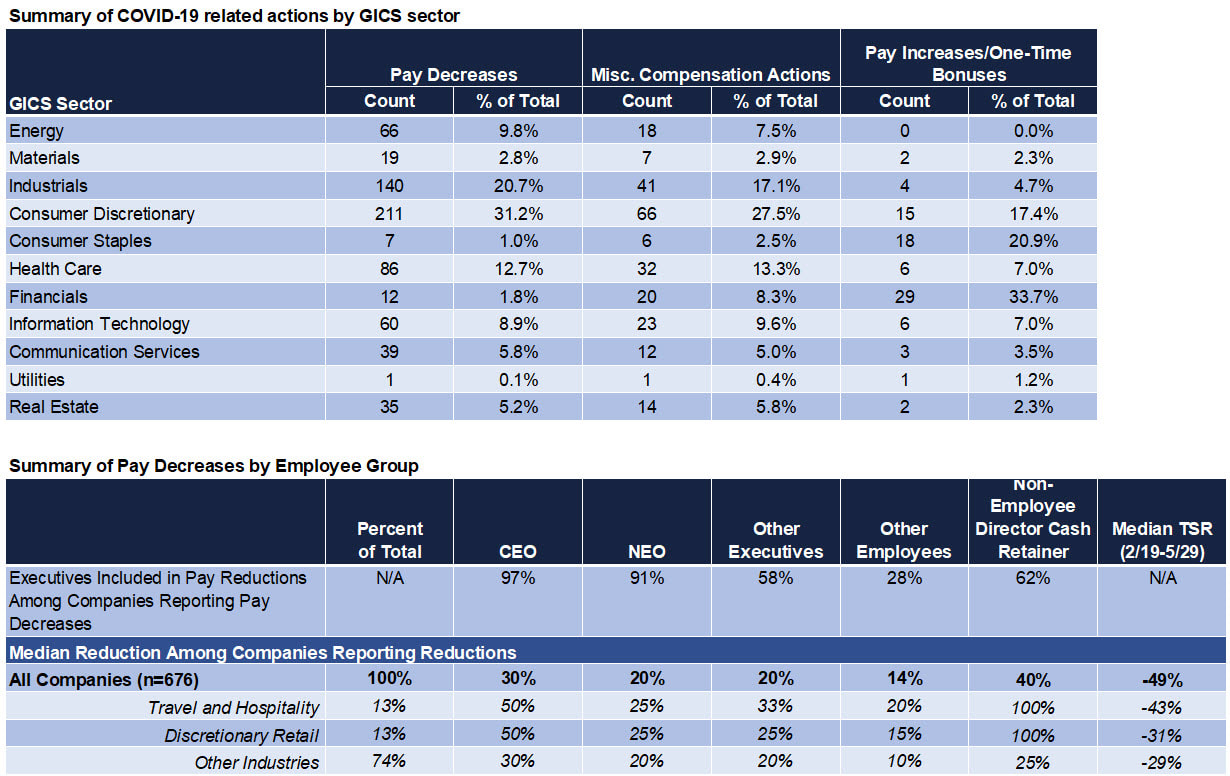

Note: Contact your Exequity Advisor for detailed information underlying these summary statistics and for special data cuts. While it is safe to say every economic crisis is different, it does not seem fair to compare this crisis to any other. The global impact of the COVID-19 pandemic is unprecedented in modern times. In turn, companies are responding with unprecedented actions. This Client Alert describes how the repercussions of COVID-19 are impacting pay programs, based on data gathered from public filings as of April 1, 2020. We will continue to update this data throughout the pandemic as companies respond, at https://www.exqty.com/newsroom/covid-19-impact-on-pay-summary-statistics.

Click here to download this Client Alert in PDF Recently, both Glass Lewis and ISS issued their U.S. policy updates for the 2020 proxy season. None of the updates are significant in and of themselves but are likely to impact a select group of companies that have not yet acted with respect to current corporate governance best practices.

This Client Alert looks at both the Glass Lewis and ISS updates as well as ISS' preliminary compensation FAQs. Click Here to download the Client Alert in PDF. Ben Burney spoke to the Michigan chapter of NASPP about trends in relative TSR. Topics covered include overall prevalence and peer group usage, among others. The presentation also included new RTSR statistics from Russell 3000 Automobile and Components companies.

Download the presentation here. |

Categories

All

|

Services |

Company |