|

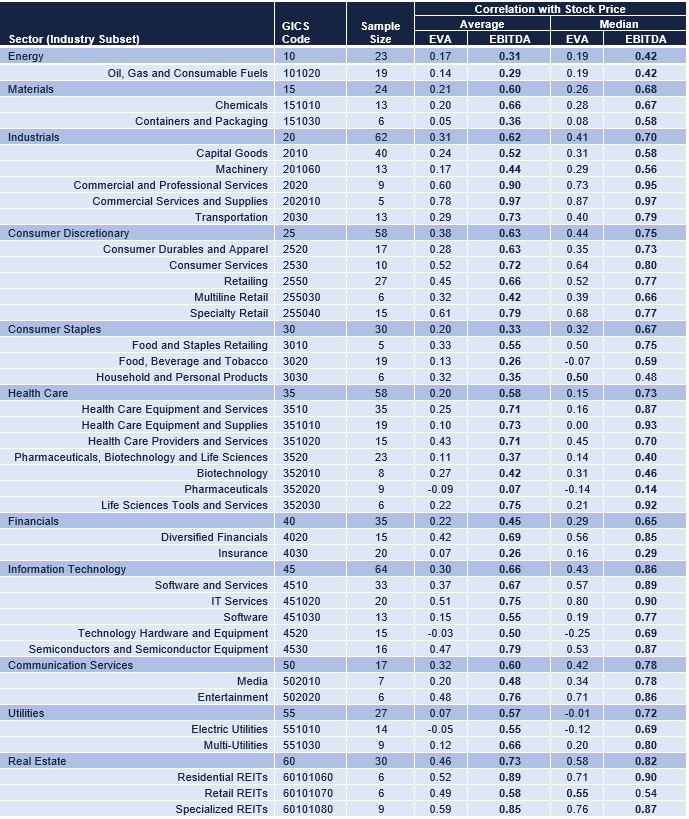

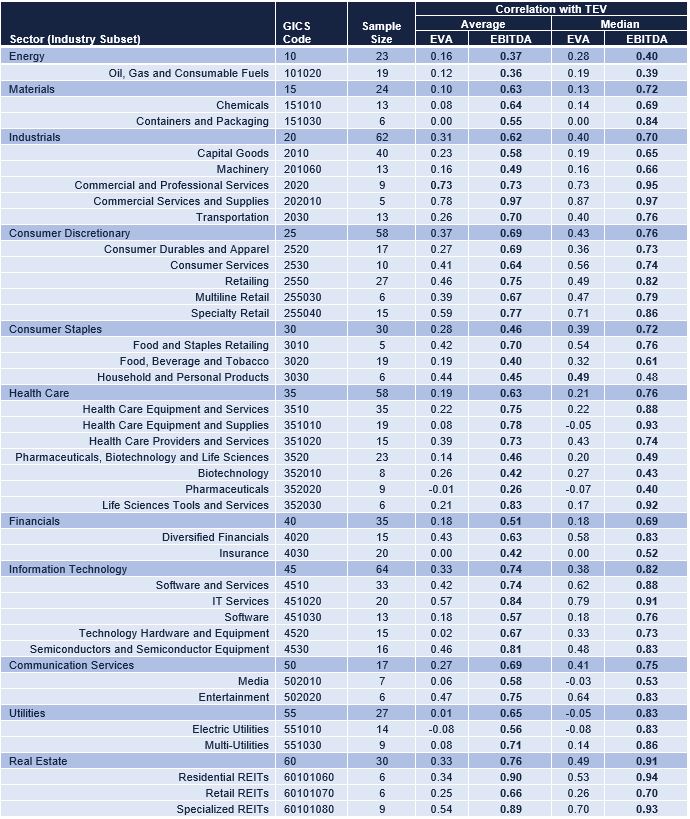

In Exequity’s August 20, 2019 Client Briefing, ISS, EVA, and Economic Voodoo, we responded to contentions made by Institutional Shareholder Services (ISS) and author Bennett Stewart (ISS Senior Advisor) in the white paper EVA, not EBITDA: A Better Measure of Investment Value. ISS and Mr. Stewart identify economic value added (EVA) as a “superior” measure of “investment value” over EBITDA. Readers may recall, EVA is ISS’s latest preferred approach to performance measurement. In contrast to ISS’s analyses, which appear to have been conducted based on data as of a single point in time, we described how EBITDA was better correlated over time with stock price and total enterprise value (TEV) than EVA. This Client Update is a follow-up to ISS, EVA, and Economic Voodoo and offers further insights into the relationship between EVA and EBITDA versus stock price and TEV. Read more below or click here to download a copy of this Client Update. Findings Consistent with the findings from our first report, we find that EBITDA is better correlated with stock price (and TEV) than EVA across nearly all industries. In a handful of industries with fewer than 10 companies, EVA and EBITDA are roughly equivalent. EBITDA correlates better over time than EVA in capital-intensive industries (Capital Goods, Containers and Packaging, and Semiconductors and Semiconductor Equipment, among others) as well as in less capital-intensive industries (Commercial and Professional Services, Retailing, and Food and Staples Retailing). Further, in industries where growth expectations have a large influence on stock prices (Software, IT Services, Biotechnology), EBITDA’s relationship with stock price (and TEV) is stronger than EVA. This trend also holds true for industries excluded by Mr. Stewart from his data sample, Real Estate and Utilities. In all, this information indicates that EBITDA is much more strongly correlated with stock price and TEV across nearly all industries than EVA. Final Thoughts As we noted in our previous Client Briefing, the guiding logic of EVA is sound. A company will be well-served by using its capital efficiently to generate profits exceeding the cost of capital. In practice, however, EVA is notoriously difficult to calculate and must be tailored to each firm’s facts and circumstances. We find ISS’s application of EVA disconcerting, and question its ability to draw meaningful conclusions about absolute company performance from its generic EVA calculations. If absolute EVA comparisons are of limited value (because of potentially unreliable calculations), will relative EVA comparisons be any more meaningful? Correlation of EVA and EBITDA with Stock Price by Industry Correlation of EVA and EBITDA with TEV by Industry Comments are closed.

|

Categories

All

|

Services |

Company |